Wonderful Irs Form 1120 Excel Template

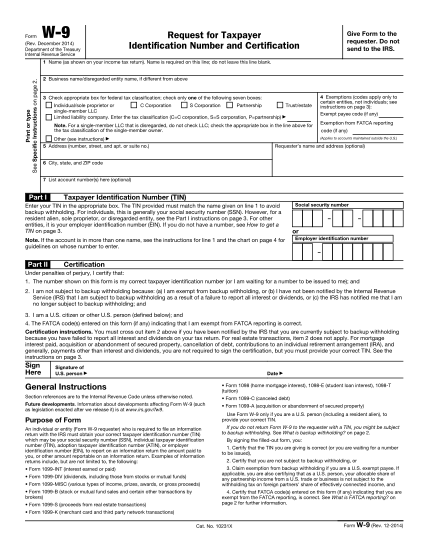

Fill in the required boxes which are yellow-colored.

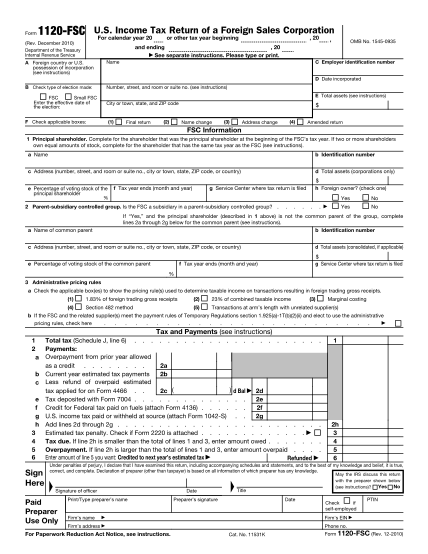

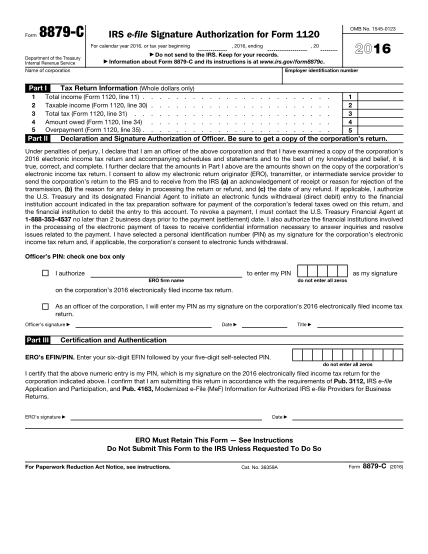

Irs form 1120 excel template. Self-Calculating IRS Form 1120 Corporate Tax Return. The tips below will help you fill out Form 1120 Excel Template quickly and easily. Use Form 8990 to calculate the amount of business interest expense you can deduct and the amount to carry forward to the next year.

IRS Form 1120S S Corporation Income Tax Return. The spreadsheet consists of three tabs one for each factor. A tax is a financial charge or other levy imposed upon a taxpayer by a state or the functional equivalent of a state to fund various public expenditures.

Most Corporations are taxed. Corporation Tax Organizer Form 1120 This organizer is provided to help you gather and organize information that will be needed in the preparation of your Corporation tax returns. To open the Apportionment spreadsheet choose View Apportionment with an 1120 return open.

Because an s-corp is a special type of business they can use a special tax form. Form 1120 Department of the Treasury Internal Revenue Service US. Does anyone have a Federal Form 1120-W Estimated Tax Spreadsheet Template for Excel.

Self-Calculating form in pdf format. Form 1120 Excel Template. Schedule B Calculator is an excel template that consists of calculations of taxable interest and ordinary dividends under Schedule B of Form 1040 and 1040A for federal income tax.

Not a pdf version of the form - but an Excel spreadsheet to be used to calculate C-corporation federal tax estimated payments. The spreadsheet is located at the top of the Apportionment Information window. Get the form 1120 downloaded online preferably from the Internal Revenue Service website and open it by using PDFelement.